Award-winning PDF software

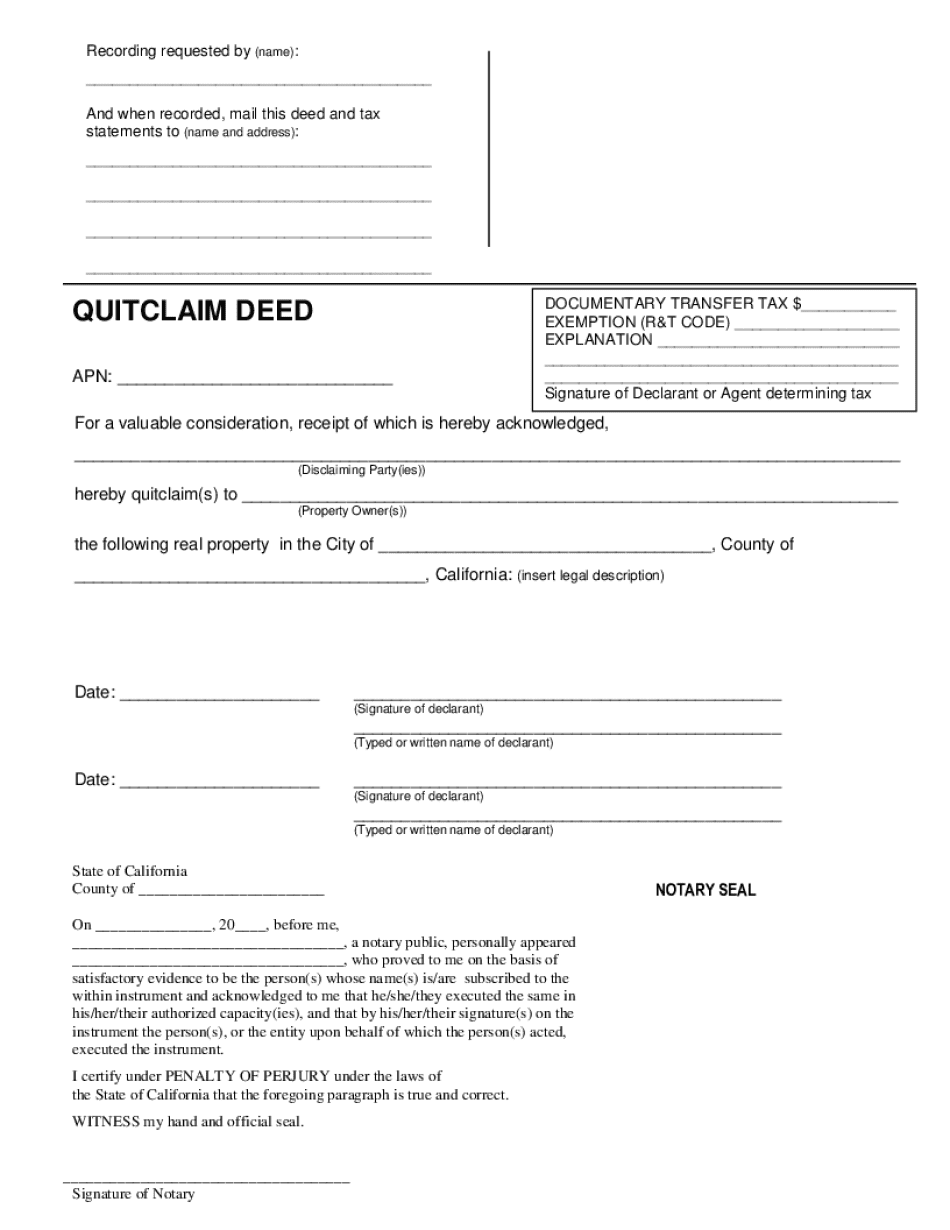

A Quitclaim Deed is a legal form to transfer ownership of the property from the grantor to the grantee. It is usually used for family needs, e.g., in marriages when someone would like to add a spouse to the title or in divorces when someone would like to exclude a spouse from the title.

When to Use a Quitclaim Deed?

There are two deeds to transfer ownership of real property in the USA:

- A warranty for real estate transactions;

- A Quitclaim for when real estate is not bought or sold.

The form is employed in two cases:

- When a family member is gifting property to a relative;

- When the insurance company is aware of other potential owners and asks them to sign the template to prevent a future claim of ownership.

It’s worth saying that the legal document covers the holding issues, not the mortgage. In the case of a mortgage, both family members share specific responsibilities.

How Does a Quitclaim Deed Work in California?

Each state has its requirements for the document. However, in California, the procedure is relatively simple and not time-consuming. First, you need to complete the blank and get it notarized. Next, submit the document to the County Recorder’s Office. The cost of filing the template in Los Angeles is $15 - basic price + $87 - additional fees.