Okay, okay, Tina. So, when you have property, you can sell it with or without a warranty. The easiest way to explain this is to think about Craigslist. I can relate this to my buddy Cory because he doesn't like buying stuff on Craigslist. He wants to get a warranty, right? Because if Cory buys something off Craigslist, let's say a piece of technology like a MacBook or headphones, and the headphones break three days later, he can't go back on Craigslist and complain. The person that sold it is going to say, "Sorry, when I sold them to you, they were working." When you buy something new from a store, it often comes with a warranty. So, when you buy a property from a tax sale and sell it for cash, it's similar to selling it on Craigslist without a warranty. Any issues or problems become the buyer's responsibility. Quiet title is necessary for selling a property with a clear title. It's common for every county in the states that have a tax sale to sell something as-is. They say "buyer beware." This is why tax lien and tax deed training is important. You have to do your own due diligence. Selling things for cash, as-is, via quitclaim means transferring ownership without warranty. Some people are okay with it, but others aren't. When dealing with higher-end properties, finding a cash buyer can be difficult, and they may need to use a bank. This is where quieting the title becomes necessary. A quiet title action can take a minimum of about three months and cost around two to two thousand five hundred dollars. However, a total freedom business superstar can help by finding cash buyers before going to an auction. Tasks and chores can be assigned to assist in finding cash buyers...

Award-winning PDF software

Quit claim deed income tax implications Form: What You Should Know

Quitclaim Deed: Should You Use It? May 11, 2025 — If the sale is from trust to trust and there is a qualified charity or for certain purposes such as donation. A Quit Claim deed does NOT remove the rights of creditors or the IRS on the property. Quit Claim Deeds: Should You Use It? March 6, 2025 — Do quitclaim deed transactions affect the federal estate tax liability? Tax Implications for a Quit Claim Deed — Tax Law Blog Quitclaim Deeds: Do They Need to Be in Writing? Oct 24, 2025 — When you transfer personal property to a qualified charity, a qualified plan, or a qualified trust, you are creating a quitclaim deed. When you transfer property from a spouse or spouse to yourself, you are creating a quitclaim deed. Should your deed include a notice Quitclaim Deeds: What Are the Tax Implications? May 17, 2025 — A quitclaim deed is not eligible for all the tax benefits that you might be getting with a transfer of property like a partnership or gift tax break. Must You Use a Quit Claim Deed? May 29, 2025 — Don't forget to make sure your estate planning documents mention how you will use your quitclaim deed and that everything you need has been properly filled out. As the owner, you should keep your paperwork up-to-date. Tax Implications of a Quit Claim Deed January 17, 2025 — An estate may be exempt from payment of federal estate tax if your property is sold, and you can prove that your property was acquired through a qualified use. What this means is that your heirs may be able to avoid the tax entirely or reduce the tax liability accordingly. Quitclaim Deeds: Do They Need a Proof of Use Letter? Feb 5, 2025 — In most cases, you are not required to provide information from your Quit Claim deed in the event of a sale.

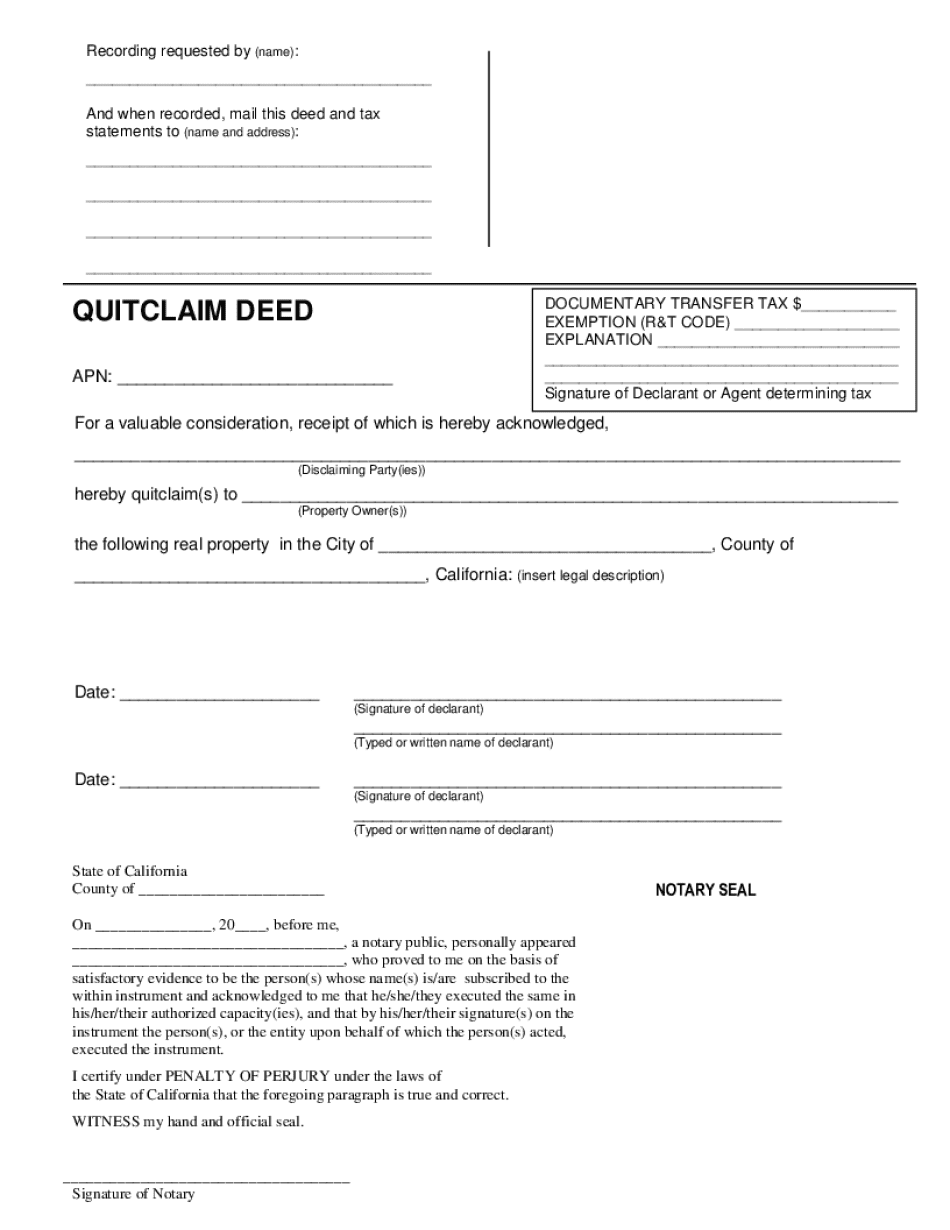

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Ca Quitclaim Deed - 2, steer clear of blunders along with furnish it in a timely manner:

How to complete any Ca Quitclaim Deed - 2 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Ca Quitclaim Deed - 2 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Ca Quitclaim Deed - 2 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Quit claim deed income tax implications