Everyone, welcome to another episode of the Ask and Me Show. My name's Edmund, I'm Jennifer, and I'm Cindy, and we're the attorneys here at AMNY Law Group in Rosemead, California. So today's topic is going to be about gifting now or leaving your assets to be inherited by your children. So, Jenn, why don't you tell us why gifting is good and bad? Gifting is something that occurs during your lifetime, so you can choose to transfer something to your kids, friends, or whoever it is while you're alive. The good thing about it is that the receiver of the asset will be very happy to have it. However, there are certain repercussions to consider with gifting. Number one is the obvious loss of control. Once you gift something, you no longer own it and lose control. For example, if I decide to gift my house to Cindy, she can do whatever she wants with it. She can kick me out, sell it, and I can no longer live there. That's the loss of control. Number two is the basis. When we buy something and earn money, there's a gain and we have to pay taxes on it. In certain situations, someone may have purchased a property 10-20 years ago at a low price. For example, a house bought for $300,000 is now worth $800,000. If they gift it now, the basis remains at $300,000. So if I gift my home to Edmund and he sells it, he would have to pay $500,000 in capital gains taxes because he gained $500,000 from the original purchase price. On the other hand, if you leave it as an inheritance, your kids receive a step-up in basis. For example, if you bought a property for $100,000 and it's worth $1 million at the time of your...

Award-winning PDF software

Gift deed california Form: What You Should Know

California Gift Deed Form — Part II — Name and Contact Information Fill out complete and sign form part two. You may now share or print this form. Be sure to read our guide on using Quick Guide on what we want from you, how to make an online gift deed. Once you are done printing, please make sure the printer is set to the 'print' setting. (If the printer is set to 'paint' or 'scan', that may cause some material to not transfer on to the page and could cause mistakes) After you have printed out your completed sample form, use our free PDF template. California Gift Deed Sample Gift Deed If you are a seller, gift will go from seller to buyer. A recipient will then need to transfer title to the buyer, including their signature on the California Gift Deed or Gift Certificate. A purchaser who is a party to a gift deed transfer can accept and sign the gift deed. A Gift Certificate can be a legal way to gift a vehicle (such as if you are buying a new vehicle). A gift certificate might also be purchased by another legal entity which is the recipient of the gift deed. It can then be gifted out to a person. This gift certificate will be similar to a title in that it will be attached to the recipient's California DMV record. California Gift Deed Form — Part I — Property Information Fill out complete and sign form part one. You may now share or print this form. Be sure to read our guide on using Quick Guide on what we want from you, how to make an online gift deed. You can download your gift deed template to print out. Click or print California gift deed form online, or give it to a friend. How a Gift Certificate can Work There are different scenarios for an electronic gift certificate purchase or gift transaction, depending on the buyer and recipient. Generally, an electronic gift certificate is issued to the buyer and their authorized transferee. This purchaser must have valid identification and must have signed the California Gift Deed or Gift Certificate.

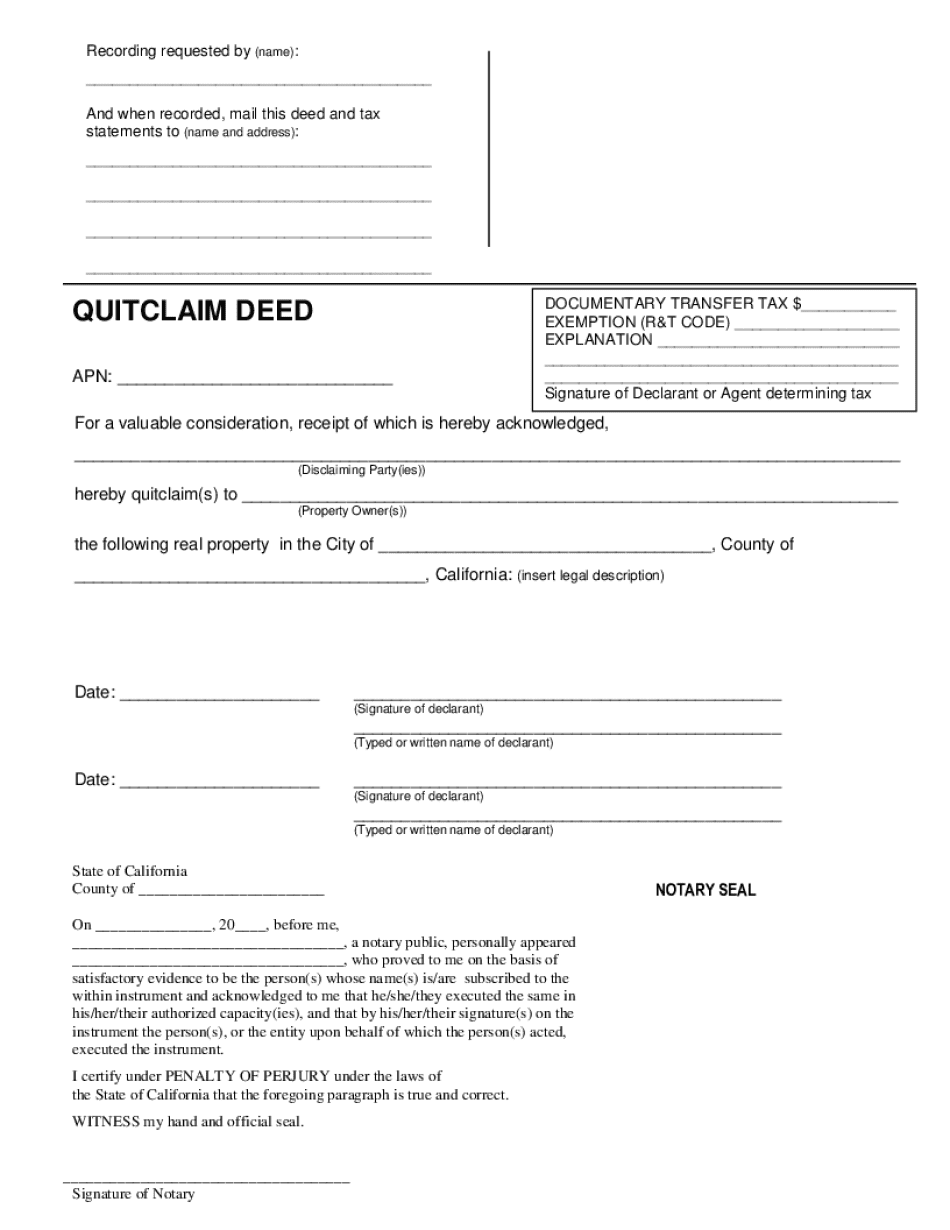

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Ca Quitclaim Deed - 2, steer clear of blunders along with furnish it in a timely manner:

How to complete any Ca Quitclaim Deed - 2 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Ca Quitclaim Deed - 2 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Ca Quitclaim Deed - 2 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Gift deed california