Music, let's talk about the transfer of property. So, what documents are needed to transfer the title of inherited property and what's the process? Transfer of property is a very relevant service that we offer. It is very obvious that if a property has been inherited, it cannot continue indefinitely in the name of the ancestors like your father or your grandfather. Why is it important? The first point is that if you actually own a property, it should be in your name. And if it is not in your name, it is not your property. I really stress that a lot of people still continue to hold properties which are in the name of their grandfather and their father, which is not correct. The reason is that these are the scenarios that unfold that if someone were to actually get into your property and grab it, if you haven't acted and if the property is not in your name, then you actually cannot even take any legal action against that person. You have to first go and transfer the property and then go to the police or the court to say that your property has been illegally grabbed. This situation is a very serious one and a lot of people are facing it. By the time they transfer the property, because it is a well-defined process, it is not something that happens automatically as probably people in the West are used to. When someone dies, the property is transferred to the next of kin. In India, it's a well-defined process. This process is time-consuming. You have to file the proper documents, which are the death certificate and the proof that this property indeed belonged to your forefathers. And then, with the proper procedures, you have to pursue these applications....

Award-winning PDF software

Selling property after name change Form: What You Should Know

Changing the Name of Personal Property Title Deeds Personal property is often transferred by a deed. The deed should include, at a minimum, the following information: Property Description and Description of Lien, Property Description, Date of Transfer of the Lien, and the name(s) or addresses of the transferee(s) or lien taker(s). Changing the Name of Land Title Deed The deed of transfer should include the following information: Property Description, Name of Landowner who transfers the property, Date of Transfer, and the names or addresses of the transferor(s) or lien taker(s) and the name(s) or addresses of the transferred property(s). If there have been no name changes from the previous owner, the new owner is not required to file the deed. The buyer need only complete a copy of the deed with the seller which includes the information listed above, and pay the selling party's costs. The seller's fee is typically 2-3% of the value of the transfer of a mortgage, lien, title (or the amount of taxes and fees) that were due under the original deed. The selling party should also provide a certified copy of the deed with the buyer which includes the information listed above. There is a provision within Section 14.076(e) of the Real Estate Transfer Act of 1993 that allows the seller of real property containing dwelling units to request a change of name on the deed issued in respect of that property, if the new seller's name is identical to the previous seller. If you sell a house, find out which name has been used in deed records and transfer your ownership by using a copy of your title certificate. If the previous owner still retains some ownership of the property or has died, you can use a Quitclaim deed for this purpose. To update your deed, you will need the current deed or a photocopy of your current deed. NOTE: The original deed and deed changes must be signed and dated under penalty of perjury. How to Update Land Title Deeds in Texas This section is the official guidance from Texas Department of Licensing and Regulation (DLR).

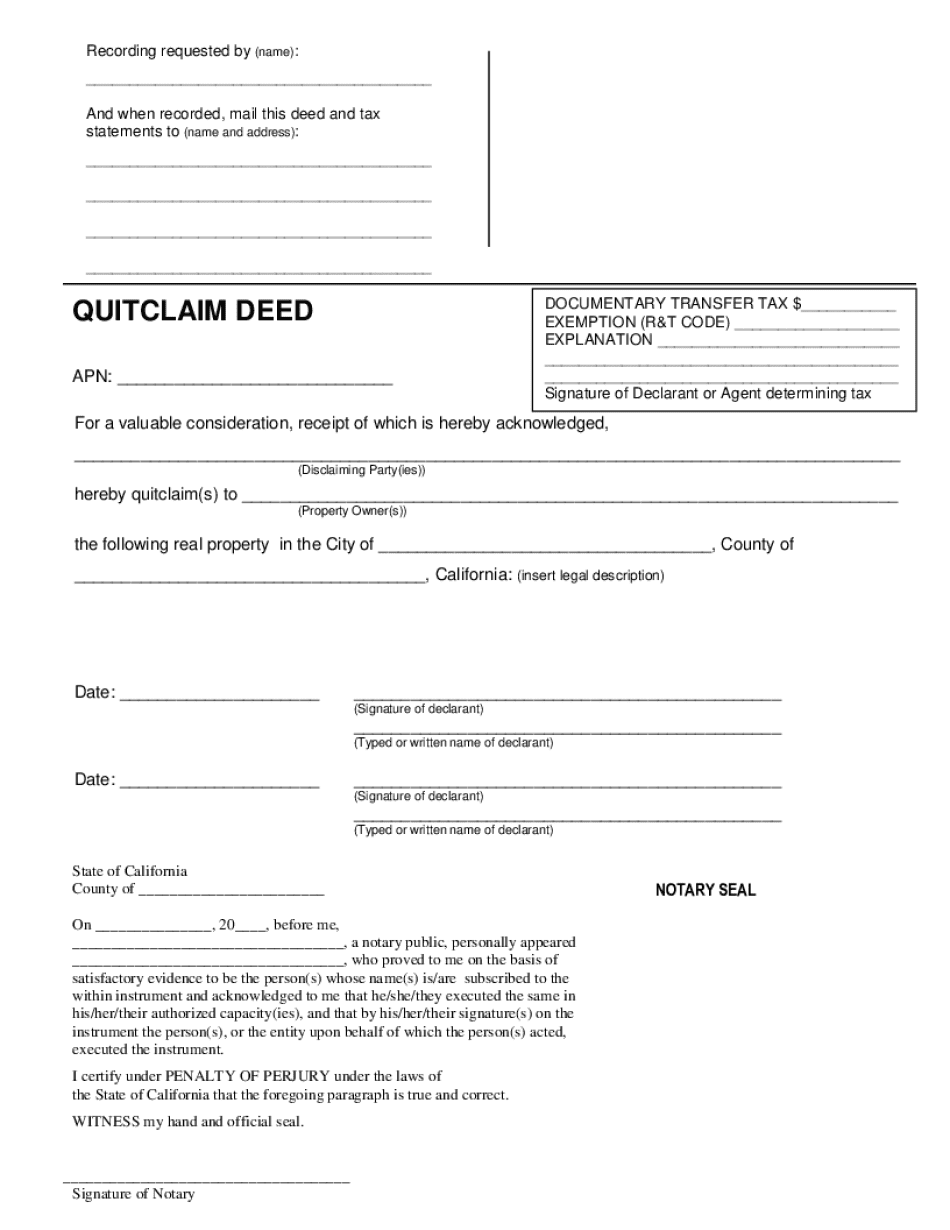

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Ca Quitclaim Deed - 2, steer clear of blunders along with furnish it in a timely manner:

How to complete any Ca Quitclaim Deed - 2 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Ca Quitclaim Deed - 2 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Ca Quitclaim Deed - 2 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Selling property after name change