Hey everybody, it's Andy and welcome again to my office in Modesto, California. I'm an attorney licensed to practice law in California as well as New York. In this video, I've been a scenario that, to be frank with you guys, actually occurs with alarming frequency, I think, in California divorce cases. The scenario relates to community property. So, for those of you who, I guess, don't know what community property is, well, maybe you live in a state that doesn't use it, let me kind of give you some background. So, whenever a couple divorces, whenever they split up, you know, for example, they inevitably have stuff that needs to get divided. It might be a house, let's say. It might be furniture, bank accounts, 401ks. It could be debt, medical debt, credit card debt, etc. So, each state basically has ways to divide stuff like that when a couple is divorcing. The way that California does it is via a scheme called community property. So, think of it like three buckets, I guess. Bucket number one is going to be all the stuff that spouse number one was supposed about. Number one is the husband. Let's all it's gonna be all the stuff that husband owned from before the marriage, all the stuff that he acquired during the marriage, should be a gift or inheritance, let's say. All of that stuff is going to be his separate property. That's going to be in this first bucket over here. If you understand that, you know, hopefully you can take that same idea and apply to spouse number two. Let's say suppose number two is the life. So, you're gonna have all of wife's separate property in bucket number two right here, and all the stuff probably, basically, be all like...

Award-winning PDF software

How to change title on house in california Form: What You Should Know

For owners with limited or no prior title in a lot with a current title, the deed must be amended in their name. For owners not having a current title, a deed amendment form must be filed with the County recorder. What does it mean if a deed is in both my name and the name of my spouse? The deed cannot be in both your name and the name of a spouse or an individual who is not related to you. What if a deed cannot be changed to the current owner? In that case, there will be no other deed to be changed. This is true even if the current title owner is deceased. This does not apply to real estate sales. If the county cannot figure out who may have a right to the property, it will use the title to figure out which owner actually owns the property. What about the deed that was in my name but sold to me but is now in an estate? Since the deed is in my name and the title is in our names (and the title is different), all heirs that may have title to the property would have to amend their names in the title in order to take title. What if I have an interest in the property? A seller's interest in property does not change to the title owner's interest. What if you don't have a current title? A new deed cannot be recorded and the property must be sold. As a last resort, the title may be sold by a foreclosure sale even if all parties interested have recorded a copy of the deed. What if I have no interest in the property? You may still sell property by foreclosure, or you may petition this court to take title from the current owner. What is an Estate? An estate is someone's legal title to property when a person dies and no one else has the legal right to the property. The owner of an interest in a residential or agricultural parcel of land has an estate interest in the property. The title for an estate has to be recorded in the county recorder's office. The deed and deed amendment do not make the estate the owner of the property since it is not in the owners name. The title would have to be taken over from the current owner once it is sold. See Also: Step-by-Step Information on Recording Your Property Records to the State of California for more information.

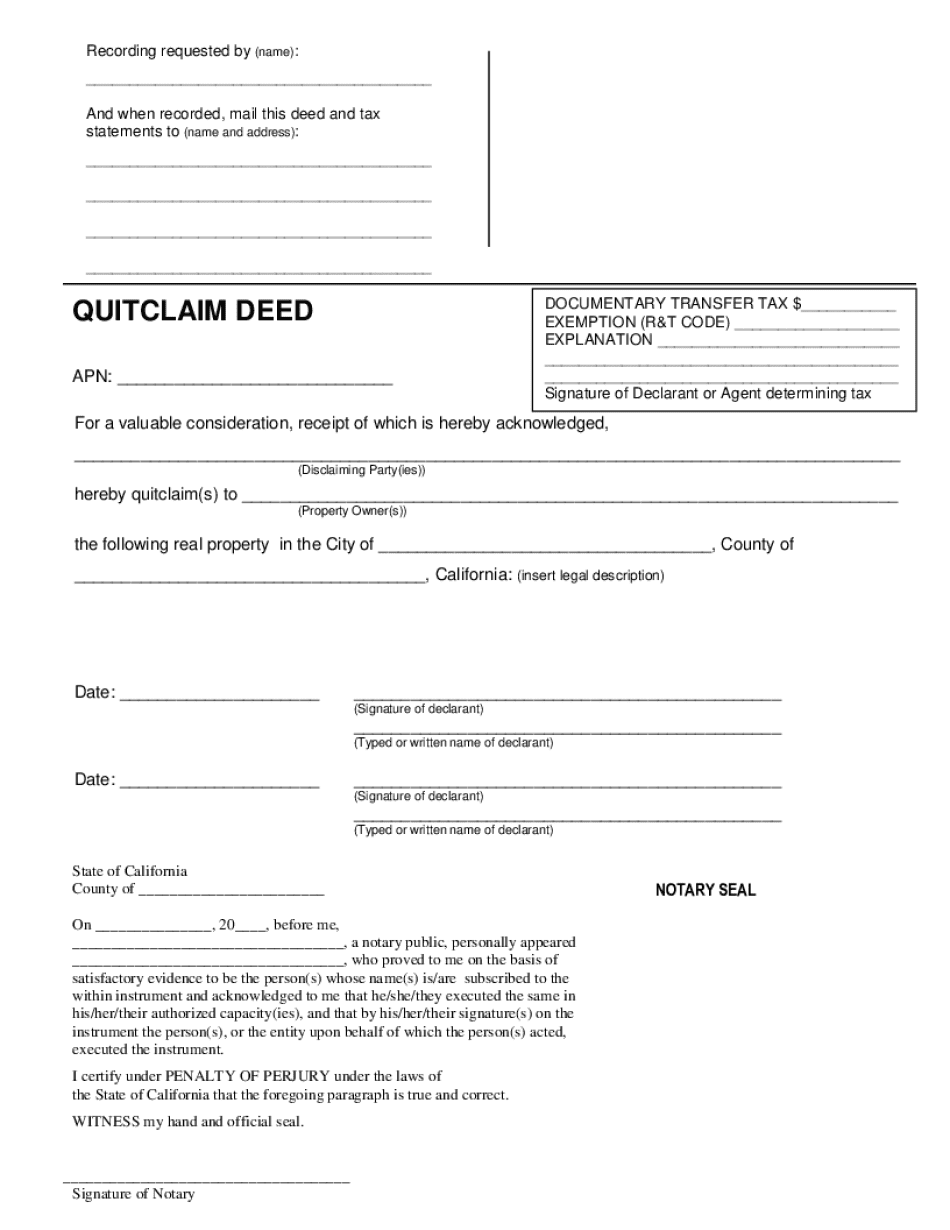

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Ca Quitclaim Deed - 2, steer clear of blunders along with furnish it in a timely manner:

How to complete any Ca Quitclaim Deed - 2 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Ca Quitclaim Deed - 2 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Ca Quitclaim Deed - 2 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing How to change title on house in california