Music. This is Gian ducek Montoya of Albertson and Davidson. Today, we're going to be filling out the claim for reassessment exclusion for a transfer between parent to child. You would be filling out this form if you are going to be receiving a property, a real property, or a qualifying property from your parents, either during their lifetime or as a result of their passing through a will, a trust, or some medium like that. So let's go ahead and get started. The first information that you're going to be filling out is in this top left. And this is going to be your information. So if you're the one receiving this property, you would fill out your name and your address. Next, in Section A, this is where you fill out the information for the real property that you're going to be receiving. The top right here is the APN or the Assessor's parcel number. You find this on the deed. So you would go ahead and go to the deed and make sure you type in this information exactly as you see it, including the spaces. Below that, you would fill in the information for the address of the real property, including the city. Under this here, recorder's document number, if you've already recorded the deed and you've received it back, you can go ahead and put the recorder's document number here and the date it was recorded. If there is a probate that's open, you put the probate case number. In the left-hand-side, this in the middle, now this is the date of death. If you're receiving this property as a beneficial interest under a probate or beneficial interest under a trust, you would put the date of death of your parent right here. If you...

Award-winning PDF software

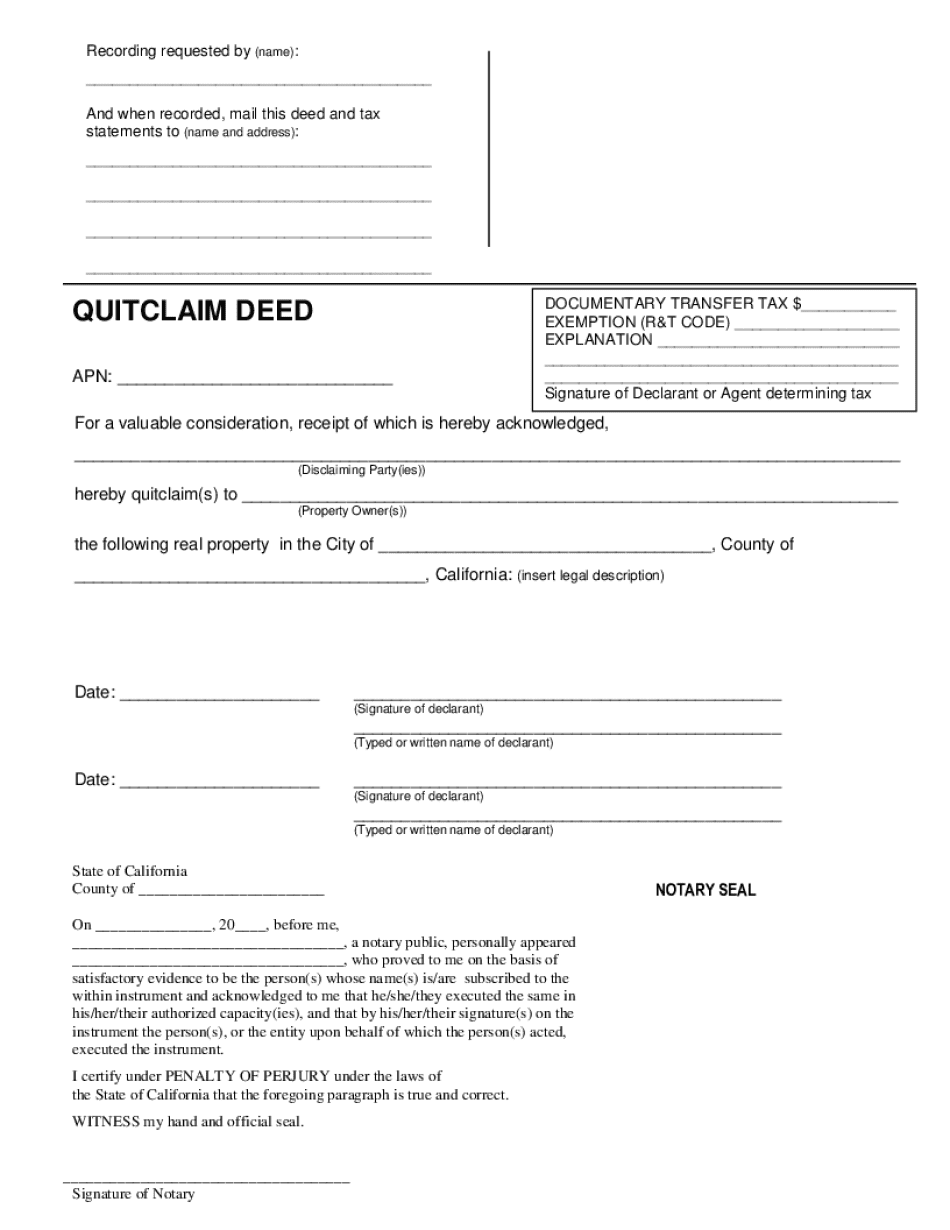

Quit Claim Deed California tax implications Form: What You Should Know

If you give a quitclaim deed, or a deed-in-lieu of a quitclaim deed, you must sign a legal instrument known as a quitclaim deed with both parents or legal guardians in order to transfer the ownership to the recipient. If you do not sign a quitclaim deed you give away the property interest to the current owner with the permission of the current owner, and you still own what you are transferring to the recipient. It is very important that you note on the quitclaim deed form that you are giving the property interest to a person not related to the recipient because if the deed of gift or transfer is not legally enforceable the recipient cannot use it to transfer the property interest, i.e. to sell the property or transfer ownership of the interest to someone else. Note: This is an important distinction because people may not know that a gift deed cannot be enforced under the State. A gift deed from a living individual is a legally enforceable and enforceable gift. A quitclaim deed is different. An “in lieu of use a gift or transfer, a copy of the title of the property and a statement that the person making the gift is the holder of an interest in such property in an amount equivalent to the fair market value of such property,” is not binding. A quitclaim deed is a transfer of ownership and will generally not be enforceable on its own, but will only have the effect of transferring the property interest to the recipient. For many people, the idea of the gift or transfer of property interest is intriguing and makes them “feel special” about a gift. They see it and the deed and think it could be the key to a great fortune or a new house or a wonderful vacation destination or the biggest and most expensive thing they have ever made on earth. But there is a big caveat.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Ca Quitclaim Deed - 2, steer clear of blunders along with furnish it in a timely manner:

How to complete any Ca Quitclaim Deed - 2 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Ca Quitclaim Deed - 2 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Ca Quitclaim Deed - 2 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Quit Claim Deed California tax implications