How to do a quitclaim deed in California. Welcome back. I'm Ted Thomas. I've been involved in real estate since 1970. For the last 30 years, I've been involved in mostly tax liens and tax defaulted property. Now, in this episode, I'm gonna cover how to do a quitclaim deed in California. Now, I formerly lived in California and they have some great deals in California for investors, which I'm going to show you some step by step process. Also, the rules are unusual and different from other states. I'll share those during this video. I'll also cover how to get started with tax lien certificates, how to make the big money with tax defaulted or tax deeds. But before I finish this video, at the very end, I'm gonna cover 2 big mistakes. You don't want to miss that because these 2 big mistakes happen at the auction and you want to miss... avoid these mistakes. So, I'll cover those In just a minute, I'll be right back. California will allow the property owner as much as 5 years to be in default before the treasurer will take action and start the confiscation and seizure process. Now, that's a long time so the taxes will really begin to add up. Now, many of the properties that I've seen at auction went as much as 7 years before they put them into default. So, as I say, the rules are different so you'll have to look at the rules differently and you'll have to act a little bit differently. Now, California is considered a deed state. That means they're gonna sell the property at auction and they will delete the mortgage when they do that. All 58 counties follow that rule. Now, as I say, it's a big state. It's got a lot of properties that they're going to sell and most of the auctions are...

PDF editing your way

Complete or edit your quitclaim deed california anytime and from any device using our web, desktop, and mobile apps. Create custom documents by adding smart fillable fields.

Native cloud integration

Work smarter and export ca quitclaim deed directly to your preferred cloud. Get everything you need to store, synchronize and share safely with the recipients.

All-in-one PDF converter

Convert and save your quit claim form as PDF (.pdf), presentation (.pptx), image (.jpeg), spreadsheet (.xlsx) or document (.docx). Transform it to the fillable template for one-click reusing.

Faster real-time collaboration

Invite your teammates to work with you in a single secure workspace. Manage complex workflows and remove blockers to collaborate more efficiently.

Well-organized document storage

Generate as many documents and template folders as you need. Add custom tags to your files and records for faster organization and easier access.

Strengthen security and compliance

Add an extra layer of protection to your quitclaim deed ca by requiring a signer to enter a password or authenticate their identity via text messages or phone calls.

Company logo & branding

Brand your communication and make your emails recognizable by adding your company’s logo. Generate error-free forms that create a more professional feel for your business.

Multiple export options

Share your files securely by selecting the method of your choice: send by email, SMS, fax, USPS, or create a link to a fillable form. Set up notifications and reminders.

Customizable eSignature workflows

Build and scale eSignature workflows with clicks, not code. Benefit from intuitive experience with role-based signing orders, built-in payments, and detailed audit trail.

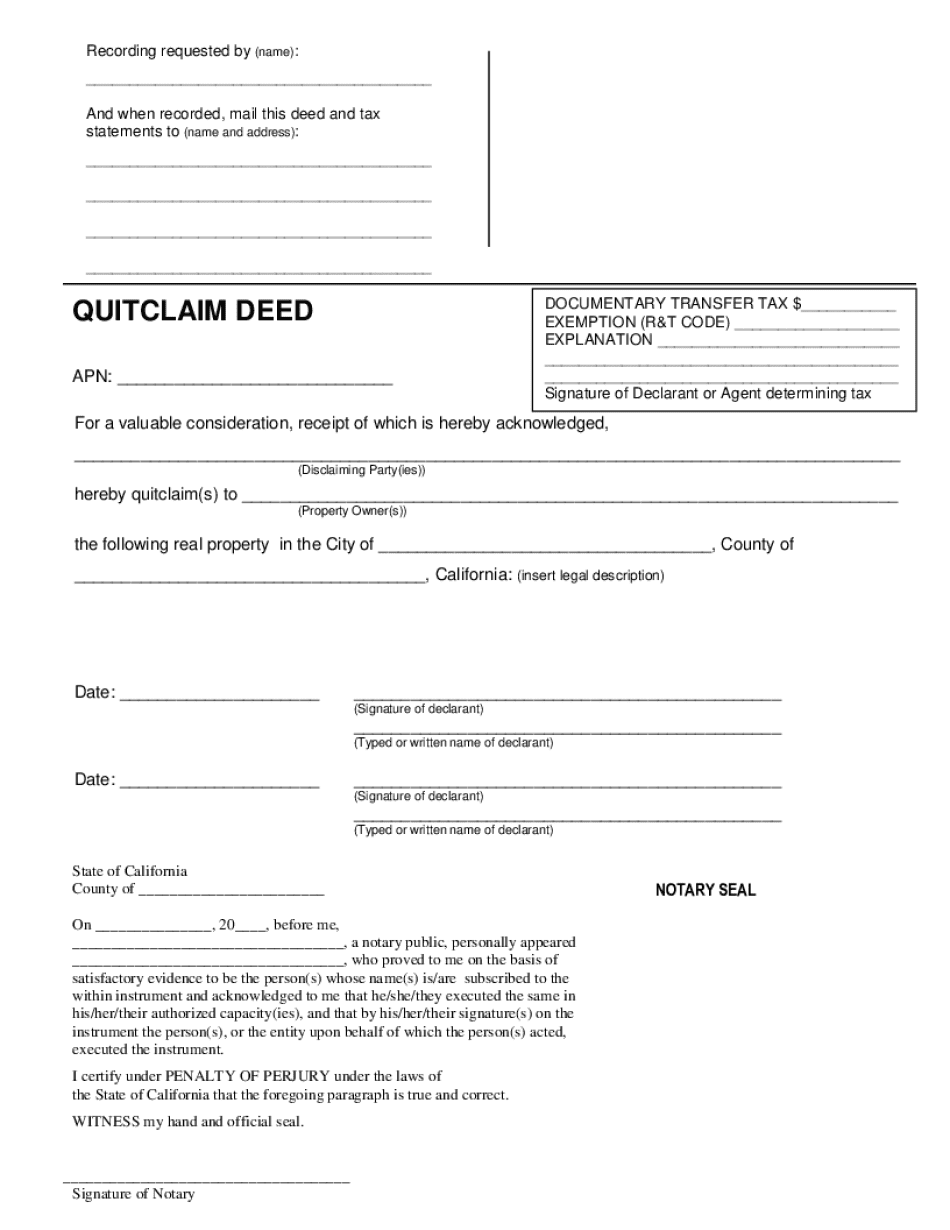

What you should know about Quit Claim Deed California

- The Quit Claim Deed form is commonly used in California for quick property transfers.

- It is important to file the Quit Claim Deed with the county recorder's office for it to be legally valid.

- Unlike a warranty deed, a Quit Claim Deed does not guarantee clear title to the property.

Award-winning PDF software

How to prepare Quit Claim Deed California

About Ca Quitclaim Deed - 2

A CA Quitclaim Deed is a legal document used to transfer ownership of property from one party (the grantor) to another (the grantee). This type of deed is commonly used in California to transfer property between family members or in situations where the property transfer is not accompanied by the sale of the property, such as gifting property or transferring property as part of a divorce settlement. The CA Quitclaim Deed is especially useful when a grantor wants to transfer the property quickly without going through the usual sale process. It is also useful in situations where there may be questions about the grantor's ownership of the property, such as when there may be outstanding liens or other issues with the property title. Overall, any individual or entity who wants to transfer ownership of property in California can use a CA Quitclaim Deed. However, it is important to note that this type of deed does not offer any guarantee of clear title or any other warranties that are typically associated with a sale of property. Therefore, it is crucial to consult with a real estate attorney to ensure that all legal requirements are met before using a CA Quitclaim Deed.

People also ask about Quit Claim Deed California

What people say about us

Decrease the possibility of errors preparing paperwork digitally

Video instructions and help with filling out and completing Quit Claim Deed California